| | |

Dividend Equivalents |

| Dividend equivalents paid on vested options

✓For future dividends, directors (including the Chief Executive Officer) will receive dividends only by means of adjustment of exercise price of options

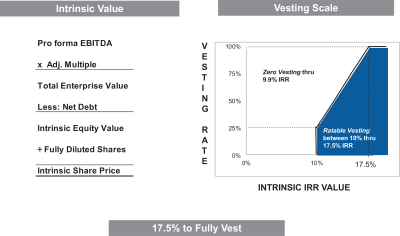

• Dividend equivalents, in cashRequires 17.5% compound annual growth for non-directors and as reduction in exercise price for directors, is permitted by stockholder-approved option plans.

AOP, which aligns performance with top performing private equity funds | |

| |

Chairman Transition | | In 2021 our Executive Chairman transitioned to non-executive Chair.

• In connection therewith, we terminated his employment agreement and issued a one-time grant of options in lieu thereof in exchange for his service as Chair through 2024.

|

For a detailed discussion of our executive compensation program, see the section entitled “Executive Compensation” beginning on page 23.

Corporate Governance

Responsible Stewardship

TransDigm’s Board and governance structure is designed to foster principled actions, informed and effective decision-making, and appropriate monitoring of compliance and performance, assuring that the long-term interests of stockholders are being served. Directors are expected to take a proactive approach to their positions to ensure that TransDigm is committed to business success through the maintenance of high standards of responsibility and ethics.

Please see our 2021 Stakeholder Report located at www.transdigm.com/investor-relations/corporate-governance/ for more information about our environmental, social and governance practices.

Selected Areas of Board and Committee Oversight in 2021

| | | | | | | | |

| TransDigm Group Incorporated | | 2024 Proxy Statement 5 |

| | | | | | | | |

| Proxy Summary | | Audit

Committee

|

Shareholder Feedback and Responsive Changes

In 2023, we requested meetings with 34 of our top 36 shareholders, representing over 70% of our outstanding common stock. Additionally, throughout 2023, there were six other shareholders, representing approximately one percent of our outstanding common stock, that proactively reached out for an engagement meeting, which TransDigm accepted. We held 37 meetings with 30 of our shareholders to obtain their feedback to our compensation program and governance. In response to this feedback, we have made the following changes.

| | Compensation

Committee

| | Nominating &

Corporate

Governance

Committee

| | Full Board

of

Directors

| | | | | |

Corporate Strategy

| Appointed a Lead

Independent Director | We have appointed a LID to strengthen our governance practices and to align with market best practices. | | | | | | ● |

Enterprise Risk Management

New Compensation

Committee Chair | We have appointed a new Compensation Committee Chair. | ● | | | | | | ● |

Cybersecurity

Refreshed Compensation

Committee | We have refreshed the members of the Compensation Committee; 67% of the members are new to the Committee. | ● | | | | | | ● |

Legal and Regulatory Compliance

| Enhanced Investor

Outreach Program | ●We have implemented a formal year-round shareholder engagement program, increasing the number of shareholder feedback meetings by almost 250%. | | | | | | ● |

Environment

Enhanced Shareholder

Feedback Disclosure | In connection with our enhanced investor outreach program, we have also enhanced our disclosure of shareholder feedback. | | | | | ● | | ● |

Diversity

| Enhanced Compensation

Program Disclosure | We have enhanced our disclosure of our compensation program, including descriptions of the carry-forward and carry-back feature of the long-term incentive plan and overall program design. | | | | ● | | ● |

Succession Planning

Enhance Disclosure of

Discretion When Used | Going forward, we will include a more fulsome disclosure if the Compensation Committee exercises discretion. | | | ● | | ● | | ● |

COVID Impact

| Increased Stock

Ownership Guidelines for

Named Executive Officers | ●We have increased our stock ownership guidelines to six times salary for the CEO and three times salary for the remaining continuing NEOs. | | ● | | | | ● |

Governance Issues

Refreshed Peer Group | We have hired a new compensation consultant and significantly refreshed our peer group to help ensure it includes representative peers. | |

| Adopted Double-Trigger Change in Control Provision | We have incorporated double-trigger change in control provisions in option agreements for NEO option awards starting in fiscal 2024. | | | ● | | ● |

For a detailed discussion of our shareholder outreach program, see the section entitled “Shareholder Engagement” beginning on page 15. CORPORATE GOVERNANCE

| | | | | | | | |

62024 Proxy Statement | | TransDigm Group Incorporated |

2023 ESG Highlights

In 2023, we also made strides towards our goal of reducing our Scope 1 and Scope 2 greenhouse gas (“GHG”) emissions by 50% by 2031. We committed to this reduction in March 2022 with fiscal 2019 as our base year that we will compare against as we expect to progress towards our emissions reduction goal. Our operating units continue to evaluate ways to reduce energy and water consumption and lower our GHG emissions through energy efficiency measures, the purchase of green power, and other actions.

Our ESG initiatives are a priority, and we are dedicated to continuous improvement as we build on our efforts. Our approach continues to evolve as we look for opportunities to expand our ESG initiatives. We firmly believe that we can continue to be financially successful while operating more sustainably and responsibly.

2023 ESG highlights include:

•Increased Board diversity to 40% (includes two females and two diverse males on TransDigm’s Board of ten directors);

•Continued to expand the Doug Peacock Scholarship Program that provides educational opportunities to underrepresented students pursuing careers in engineering or business;

•Opened the TransDigm Group Learning Center to support educational programming at the Great Lakes Science Center;

•Progression towards our GHG reduction goal - total Scope 1 and Scope 2 emissions are down compared to our baseline year of fiscal 2019; and

•TransDigm operating units worked to evaluate and/or implement actions to lower GHG emissions including:

◦Use of renewable energy sources, including solar power, hydropower and wind power;

◦LED lights or motion sensing lights;

◦Higher efficiency HVAC units; and

◦Other energy efficient building upgrades such as tinted windows, skylights, stucco coatings, improved insulation, and programmable thermostats.

| | | | | | | | |

| TransDigm Group Incorporated | | 2024 Proxy Statement 7 |

Corporate Governance

This section describes the role and structure of TransDigm’s Board of Directors and our corporate governance framework.Role of the

Board

of DirectorsLeadership Structure

TransDigm’s Board

consists of a standing Audit Committee, Compensation Committee, Nominating and Corporate Governance Committee, and Executive Committee. The Chairman, which is separate from the CEO role, oversees the

Chief Executive Officer and other senior management in the competent and ethical operation of TransDigm and ensures that the long-term interests of stockholders are being served. To satisfy the Board’s duties, directors are expected to take a proactive approach to their positionsBoard to ensure that

TransDigmit is

committed to business successfunctioning effectively and

high standards of responsibility and ethics.TransDigm’s key governance documents, including our Corporate Governance Guidelines, are available at www.transdigm.com/investor-relations/corporate-governance. The Board met seven times during 2021. In fiscal 2021, independent directors met in executive session after each regularly scheduled Board meeting. Each member ofserving the Board who served during 2021 attended or participated in 75% or more of the aggregate of the total number of meetings of the Board and each committee of the Board on which such member served during 2021, except that Mr. Dunn attended less than 75% of the meetings. Mr. Dunn missed one Board meeting and two committee meetings as a result of a medical emergency that occurred on the date of the committee meetings and after he had already traveled to Cleveland for the meetings; he was still in the hospital for the Board meeting the following day. In addition, Mr. Dunn missed two telephonic meetings relating to TransDigm’s potential acquisition of Meggitt plc that were called on short notice.

The Board does not hold a meeting on the dateinterests of our annual stockholder meeting and we have not established a policy regarding director attendance at the stockholder meeting. Two directors attended the 2021 annual stockholder meeting.

Composition of the Board and its Committees

shareholders. The Board believes that its current leadership structure, in which the roles of Chairman and CEO are separated, best serves the Board’s ability to carry out its roles and responsibilities on behalf of TransDigm’s stockholders,shareholders, including its oversight of management. The Board also believes that the currentthis structure allows our CEO to focus on managingdrive the performance and strategic vision of TransDigm, while leveraging our Chairman’s experience with respect to capital allocation, acquisitions and the strategic vision and culture of TransDigm andability to drive accountability at the Board level. In 2023, TransDigm also added the role of LID to further foster the role of independent directors on the Board and strengthen the Board’s alignment with its shareholders.

The Board has determined this structure enables the Board and its committees to carry out their roles and responsibilities effectively.

The Board has determined that all Board members, other than Messrs. Stein,

Howley, and

Howley,Valladares, are independent under applicable rules of the New York Stock Exchange (“NYSE”).

The Board also determined that Messrs. Staer and Dunn, who retired from the Board in October 2023, were independent under the applicable rules of the NYSE.

Addition of the Lead Independent Director

The LID functions as an important conduit for communications between the independent directors and TransDigm’s management. The LID role is designed to help ensure that the interests of TransDigm’s shareholders are being served. Since late 2023, Mr. Small has served as the LID. In furtherance of these goals, the LID has the following roles and responsibilities:

| | | | | | | | | | | | | | | | | |

| | | | | |

| •Review, advise, and set board meeting agendas and schedules, including to help assure that there is sufficient time allocated for discussion of all agenda items •Suggest to the Chairman agenda items for meetings of the Board and approve the agenda, as well as the substance and timeliness of information sent to the Board •Call and preside over executive sessions •Facilitate communications and act as a liaison between non-independent directors and the Chairman and management •Preside at board meetings in the absence of the Chairman | | | •Consult and communicate with major shareholders as requested •Lead the board and director evaluation process with support of the Chair of the Nominating and Corporate Governance Committee •Provide input on the design of the Board, including Board and committee composition, size, membership, leadership, structure, and oversight responsibilities, as part of the Board’s and the Nominating and Corporate Governance Committee’s periodic review of such matters •Act as a resource for, and counsel to, the Chairman | |

| | | | | |

Refreshed Composition of the Board’s Committees

As part of its annual evaluation of the Board has a standing Audit Committee,and its Committees’ responsibilities, the Board refreshed the membership of its Committees in calendar year 2023 in order to bring fresh perspectives to the Committees’ roles and responsibilities. The Compensation Committee, Nominating &and Corporate Governance Committee, and Executive Committee each have new members. The Compensation Committee has a new Chair, Mr. Barr. In addition, 67% of the Compensation Committee’s members are new to the Committee. The Nominating and Corporate Governance Committee and Executive Committee consist of 50% and 33% new members, respectively.

| | | | | | | | |

82024 Proxy Statement | | TransDigm Group Incorporated |

The Board has determined that all members of the Audit Committee, Compensation Committee, and Nominating &and Corporate Governance Committee are independent under applicable NYSE and Securities and Exchange Commission (“SEC”)SEC rules for committee memberships and that each member of the Audit Committee also meets the additional independence criteria set forth in Rule 10A-3(b)(1) under the Securities Exchange Act of 1934, as amended (the “Exchange Act”).Act.

Each committee operates under a written charter adopted by the Board, each of which is available on our website at www.transdigm.com/investor-relations/corporate-governance/. The current composition of the Board and its committees is as follows: | | | | | | | | | | | | | | | | | |

| Independent | Audit

Committee | Compensation Committee | Compensation

Nominating and Corporate Governance | Executive Committee |

| Nominating

& Corporate

Governance

Committee

| | Executive

Committee

| | Independent

|

| David A. Barr | | # of Other Public

Company Boards

|  * * | | |

| Jane M. Cronin | | l | | l* | |

| Michael Graff | | | | l* | l* |

| Sean P. Hennessy | | | | | |

| W. Nicholas Howley, Chairman | | | | | |

| Gary E. McCullough | | | l* | | |

| Michele L. Santana | | l | | l | |

| Robert J. Small, LID | | | l | | l |

| Kevin M. Stein, President and CEO | | | | | |

| Jorge L. Valladares III | | | | | |

| | | | | |

ChairlMember * Appointed to the committee in 2023

ChairlMember * Appointed to the committee in 2023 | | | | | | | | |

| TransDigm Group Incorporated | | 2024 Proxy Statement 9 |

Board Tenure

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 4 members | | 2 members | | 4 members |

| | | | | | | | | | | |

| | | | | | |

David Barr

| | | | | | ● | | | | ● | | 0 |

| | | | | | | | | | | |

Jane Cronin

0-5 years | | ●6-10 years | | More than 10 years |

| | | | | | ● | | 0 |

| | | | | | |

Mervin Dunn

Audit Committee | | | | ● | | ● | | | | ● | | 0Responsibilities The Audit Committee oversees issues regarding accounting and financial reporting processes and audits of TransDigm’s financial statements; assists the Board in monitoring the integrity of TransDigm’s financial statements, compliance with legal and regulatory requirements, independent auditor’s qualifications, and independence and the performance of TransDigm’s internal audit function and independent auditors; is responsible for the appointment, compensation, retention, and oversight of the work of TransDigm’s independent auditors; and provides a forum for consideration of matters relating to audit issues, enterprise risk management, and cybersecurity. Each Audit Committee member is independent under NYSE listing standards and as such term is defined in Rule 10A-3(b)(1). The Board has also determined that Mr. Hennessy, Ms. Santana, and Ms. Cronin each qualify as an “audit committee financial expert.” |

| |

| |

Members Sean P. Hennessy (Chair) Jane M. Cronin Michele L. Santana | |

| |

| |

Meetings 8 | |

| |

| |

| | | | | | | | |

Michael Graff

Compensation Committee | | | |  | | | | | | ● | | 0Responsibilities The Compensation Committee discharges the Board’s responsibilities relating to compensation of TransDigm executives and directors; oversees TransDigm’s compensation and employee benefit plans and practices; and has sole discretion concerning administration of TransDigm’s stock option plans, including selection of individuals to receive awards, types of awards, the terms and conditions of the awards, and the time at which awards will be granted, other than awards to directors, which are approved by the full Board. To the extent permitted under NYSE listing standards and applicable law, the Compensation Committee may delegate its power and authority as it deems appropriate to subcommittees of no fewer than two members that it may form from time to time. The Compensation Committee may also delegate certain of its authority pursuant to the terms of TransDigm’s stock option plans to one or more officers or other employees of TransDigm, subject to NYSE listing standards, applicable law, and the terms of such plans. For a description of the Compensation Committee’s processes and procedures, including the roles of its independent compensation consultant and the CEO in support of the Compensation Committee’s decision-making process, see the section entitled “Compensation Discussion and Analysis” beginning on page 32. Each Compensation Committee member is independent under NYSE listing standards, and a “non-employee director” as defined in Section 16(b) of the Exchange Act. In determining independence, the Board affirmatively determined that none of the Compensation Committee members has a relationship with TransDigm that is material to his ability to be independent from management in connection with his duties on the Compensation Committee. |

| |

| |

Members David A. Barr (Chair)* Gary E. McCullough* Robert J. Small *Appointed to the committee in 2023 | |

| |

| |

Meetings 5 | |

| |

| |

| | | | | | | | |

Sean Hennessy

102024 Proxy Statement | |  |

| | ● | | | | ● | | ● | | 1 |

| | | | | | |

W. Nicholas Howley, Chairman

| | Corporate Governance |

| | | | | |  | | | | 1 |

| | | | | | |

Raymond Laubenthal

Nominating and Corporate Governance Committee | | | | | | | | | | ● | | 0Responsibilities The Nominating and Corporate Governance Committee’s duties and responsibilities include overseeing and assisting the Board in identifying and recommending nominees for election as directors; recommending to the Board qualifications for committee membership, structure, and operation; recommending to the Board directors to serve on each committee; developing and recommending to the Board corporate governance policies and procedures; providing oversight with respect to corporate governance; leading the Board in its annual performance review of the Board and management; overseeing TransDigm’s succession planning; and overseeing TransDigm’s ESG initiatives. Each Nominating and Corporate Governance Committee member is independent under NYSE listing standards. In accordance with its charter and TransDigm’s Corporate Governance Guidelines, the Nominating and Corporate Governance Committee has evaluated and recommended to the Board each of the nominees named in this proxy statement for election to the Board. |

| |

| |

Members Gary E. McCullough (Chair) Jane M. Cronin* Michael Graff* Michele L. Santana *Appointed to the committee in 2023 | |

| |

| |

Meetings 4 | |

| |

| | | | | | | | |

Gary E. McCullough

Executive Committee | | ● | | | |  | | | | ● | | 1Responsibilities The Executive Committee possesses the power of the Board during intervals between Board meetings. |

| |

| |

Members W. Nicholas Howley (Chair) Michael Graff* Robert J. Small *Appointed to the committee in 2023 | |

| |

| |

| The Executive Committee held no formal meetings during fiscal 2023. | |

| |

| | | | | | | | |

Michele Santana

TransDigm Group Incorporated | | ●2024 Proxy Statement 11 |

| | | | ● | | | | ● | | 0 |

| | | | | | |

Robert Small

| | | | ● | | | | ● | | ● | | 0 |

| | | | Corporate Governance | | |

John Staer

| | ● | | | | ● | | | | ● | | 0 |

| | | | | | |

Kevin Stein, President and CEO

| | | | | | | | | | | | 0 |

Chair

Audit Committee

The Audit Committee oversees issues regarding accounting and financial reporting processes and audits of TransDigm’s financial statements; assists the Board in monitoring the integrity of TransDigm’s financial statements, compliance with legal and regulatory requirements, independent auditor’s qualifications and independence and the performance of TransDigm’s internal audit function and independent auditors; is responsible for the appointment, compensation, retention and oversight of the work of TransDigm’s independent auditors; and provides a forum for consideration of matters relating to audit issues, enterprise risk management and cybersecurity. Each Audit Committee member is independent under NYSE listing standards and as such term is defined in Rule 10A-3(b)(1). The Board has also determined that Mr. Hennessy, Ms. Santana and Ms. Cronin each qualify as an “audit committee financial expert”. The Audit Committee met eight times during 2021.

Compensation Committee

The Compensation Committee discharges the Board’s responsibilities relating to compensation of TransDigm executives; oversees TransDigm’s compensation and employee benefit plans and practices; and has sole discretion concerning administration of TransDigm’s stock option plans, including selection of individuals to receive awards, types of awards, the terms and conditions of the awards and the time at which awards will be granted, other than awards to directors, which are approved by the full Board. For a description of the Compensation Committee’s processes and procedures, including the roles of its independent compensation consultant and the CEO in support of the Compensation Committee’s decision-making process, see the section entitled “Compensation Discussion and Analysis” beginning on page 23. Each Committee member is independent under NYSE listing standards, and a “non-employee director” as defined in Section 16(b) of the Securities Exchange Act of 1934. In determining independence, the Board affirmatively determined that none of the Compensation Committee members has a relationship with TransDigm that is material to his ability to be independent from management in connection with his duties on the Committee. The Compensation Committee met six times during 2021.

Nominating & Corporate Governance Committee

The Nominating & Corporate Governance Committee’s duties and responsibilities include overseeing and assisting the Board in identifying and recommending nominees for election as directors; recommending to the Board qualifications for committee membership, structure and operation; recommending to the Board directors to serve on each committee; developing and recommending to the Board corporate governance policies and procedures; providing oversight with respect to corporate governance; leading the Board in its annual performance review; overseeing TransDigm’s succession planning; and overseeing TransDigm’s environmental, social and governance initiatives. Each Nominating & Corporate Governance Committee member is independent under NYSE listing standards. The Nominating & Corporate Governance Committee met four times during 2021.

In accordance with its charter and TransDigm’s Corporate Governance Guidelines, the Nominating & Corporate Governance Committee has evaluated and recommended to the full Board each of the nominees named in this Proxy Statement for election to the Board.

Executive Committee

The Executive Committee possesses the power of the Board of Directors during intervals between Board meetings. The Executive Committee held no formal meetings during fiscal 2021.

Corporate Governance Policies and Practices

TransDigm’s governance framework is designed to foster principled actions, informed and effective decision-making, and appropriate monitoring of compliance and performance.

| | | | | | | | |

Separation of Chairman

and CEO roles | We have a separate Chairman and CEO. | |

Annual director elections

Lead Independent Director | We have appointed a LID to further alignment with shareholders and to align with market best practices. | All directors are elected annually for a one-year term

|

| Refreshed Committees | We have refreshed the membership of three of our four committees. 67% of the members of the Compensation Committee are new to the Compensation Committee. 50% of the members of the Nominating and Corporate Governance Committee are new. | |

Retirement policyPolicy | | Directors are required to retire from the Board when they reach age 75 subject to waiver by the Board upon the recommendation of the Nominating &and Corporate Governance Committee Committee. | |

| Proxy Access | |

Proxy access | | Up to 20 stockholdersshareholders owning at least 3% of sharesoutstanding common stock continuously for three years may nominate up tothe greater of two directors or 20% of the board seats. | |

| Annual Director Elections | All directors are elected annually for a one-year term. | |

Separation of Chair and CEO roles | | We have a separate Chairman and CEO

|

| |

Prohibitions on hedging, pledging Hedging, Pledging

and short

selling Short Selling | | We prohibit short sales, transactions in derivatives, hedging, and pledging of TransDigm securities by all directors and employees employees. | |

| Stock Ownership Guidelines | |

Stock ownership guidelines | | We have robust equity ownership guidelines for our directors, officers, and management employees employees. We have increased our stock ownership guidelines to six times salary for the CEO and three times salary for the remaining continuing NEOs. | |

| Succession Planning | |

Succession planning | | Our Board regularly reviews executive succession planning planning. | |

Responsible Stewardship & Role of the Board of Directors

TransDigm’s Board and governance structure is designed to foster principled actions, informed and effective decision-making, and appropriate monitoring of compliance and performance, to ensure that the long-term interests of shareholders are being served. Directors are expected to take a proactive approach to ensure that TransDigm is committed to business success through the maintenance of high standards of responsibility and ethics. Our risk management program is designed to identify, assess, and prioritize our risk exposures across various timeframes, from the short term to the long term. Further, the enterprise risk management program and our disclosure controls and procedures are designed to appropriately escalate key risks to the Board as well as analyze potential risks for disclosure.

TransDigm’s Board oversees the CEO and other senior management in the competent and ethical operation of TransDigm and ensures that the long-term interests of shareholders are being served.

TransDigm’s key governance documents, including our Corporate Governance Guidelines, are available at www.transdigm.com/investor-relations/corporate-governance. The Board met four times during fiscal 2023. In fiscal 2023, non-executive and independent directors met in executive session after each regularly scheduled Board meeting. Each member of the Board who served during fiscal 2023 attended or participated in 75% or more of the aggregate of the total number of meetings of the Board and each committee of the Board on which such member served during fiscal 2023.

The Board does not hold a meeting on the date of our annual shareholder meeting and we have not established a policy regarding director attendance at the annual shareholder meeting. One director attended the 2023 Annual Meeting. No non-employee shareholders attended the 2023 Annual Meeting.

| | | | | | | | |

122024 Proxy Statement | | TransDigm Group Incorporated |

| | | | | | | | |

Annual board and committee self-evaluations | | Our Board and committees conduct annual performance evaluations

Corporate Governance |

Board Oversight of Risk Management

The Board believes that evaluating the executive team’s management of the risks confronting TransDigm is one of its most important areas of oversight. In carrying out this responsibility, the Board is assisted by each of its committees that considers risks within its areas of responsibility and apprises the full Board of any significant risks and management’s response to those risks. The Board has retained primary oversight of certain areas of risk and management’s response, including corporate strategy. While the Board and its committees exercise oversight of risk management, management is responsible for implementing and supervising day-to-day risk management processes and reporting to the Board and its committees.

Our risk management program is designed to identify, assess, and prioritize our risk exposures across various timeframes, from the short term to the long term. Further, the enterprise risk management program and our disclosure controls and procedures are designed to appropriately escalate key risks to the Board as well as analyze potential risks for disclosure.

Areas of Board and Committee Oversight in 2023

| | | | | | | | | | | | | | |

| Audit

Committee | Compensation

Committee | Nominating

and Corporate

Governance

Committee | Full Board

of Directors |

| | | | |

| Corporate Strategy | | | | l |

| Enterprise Risk Management | ● | | | ● |

| Cybersecurity | ● | | | ● |

| Legal and Regulatory Compliance | ● | | ● |

| ESG | | | ● | ● |

| Diversity and Inclusion | | | ● | ● |

| Succession Planning | | ● | ● | ● |

| Human Capital Management | | ● | ● | ● |

| Corporate Governance | | | ● | ● |

Audit Committee’s Role in Oversight of Risk Management

The Audit Committee is charged with the primary responsibility for overseeing enterprise risk management. In accordance with this responsibility, the Audit Committee reviews and discusses with management its program to identify, assess, monitor, manage, and mitigate TransDigm’s significant business risks, including financial, operational, data security,cybersecurity, business continuity, tax, legal and regulatory compliance, and reputational risks. Compensation Committee’s Role in Oversight of Risk Management

The Compensation Committee has primary responsibility to oversee risks related to our compensation programs. In establishing and reviewing our compensation programs, the Compensation Committee

evaluatedevaluates whether the design and operation of our compensation programs

orand policies encourage our executive officers or our

other employees to take unnecessary or excessive risks. The Compensation Committee concluded that TransDigm’s compensation programs and policies provide an effective and appropriate mix of incentives to help ensure performance is focused on long-term

stockholdershareholder value creation and do not encourage short-term risk taking at the expense of long-term results or create risks that are reasonably likely to have a material adverse effect on TransDigm.

Nominating and Corporate Governance Committee’s Role in Oversight of Risk Management

The Nominating and Corporate Governance Committee has primary oversight responsibility of our initiatives related to diversity and inclusion and ESG, including sustainability. In accordance with this responsibility, the Nominating and Corporate Governance Committee annually assesses our ESG risks. The Nominating and Corporate Governance Committee also works with the Board to nominate and evaluate potential successors to the CEO position and provide an annual report to the Board concerning succession planning.

| | | | | | | | |

| TransDigm Group Incorporated | | 2024 Proxy Statement 13 |

Annual Board and Committee Self-Evaluations

The Board conducts an annual self-evaluation that is intendeddesigned to determine whetherevaluate the performance of the Board. In particular, the self-evaluation is designed to obtain feedback on topics such as board composition, effectiveness of communication, and accountability to TransDigm’s shareholders. In addition, the assessment seeks feedback on potential opportunities to enhance the effectiveness of the Board, including content to include in Board meetings and continued education. The results of the self-assessment are shared with the Board and its committees are functioning effectively. considered for implementation.

In addition, each of the Audit, Compensation, and Nominating

&and Corporate Governance Committees conducts its own annual self-evaluation and reports the results to the Board. Discussion topics include, among others, Board and committee composition and leadership, meeting effectiveness, appropriateness of agenda topics and information, access to management and outside auditors, and succession planning.

We are committed to integrity and ethical behavior and have adopted a Code of Business Conduct and Ethics, a Code of Ethics for Senior Financial Officers, a Code of Business Conduct and Ethics and a Whistleblower Policy. Each of these documents is posted on TransDigm’s website, www.transdigm.com, under “Investor Relations—Corporate Governance” and is available to any stockholdershareholder in writing upon request to TransDigm. We have a Code of Business Conduct and Ethics that reflects TransDigm’s commitment to honesty, integrity, and the ethical behavior of our employees, officers,

directors, and

directors.agents. The Code of Business Conduct and Ethics governs the actions, interactions, and working relationships of our employees, officers,

directors, and

directorsagents with customers, fellow employees, competitors, government, and self-regulatory agencies, investors, the public, the media, and anyone else with whom we have contact. The Code of Business Conduct and Ethics sets forth the expectation that employees, officers,

directors, and

directorsagents will conduct business legally and addresses conflict of interest situations, international trade compliance, protection and use of TransDigm assets, corporate opportunities, fair dealing, confidentiality, human rights, and reporting of illegal or unethical behavior. The Code of Business Conduct and Ethics expressly prohibits paying, offering, accepting, or soliciting bribes in any form, directly or indirectly. Only the Board or the Nominating

&and Corporate Governance Committee may waive a provision of the Code of Business Conduct and Ethics with respect to an executive officer or director. Any such waiver will be promptly disclosed on our website and as otherwise required by rule or regulation. There were no such waivers in

2021.2023.

We also have a Code of Ethics for Senior Financial Officers that includes additional obligations for our senior financial officers (which includes our presidentPresident and chief executive officer, chief operating officer, chief financial officer, chief accounting officer, vice presidentCEO, Co-COOs, CFO, Vice President of finance, treasurer, directorFinance, Treasurer, Director of internal audit, general counsel, operating unit presidentsInternal Audit, General Counsel, Operating Unit Presidents, and operating unit vice presidentsOperating Unit Vice Presidents of finance)Finance).

Only the Audit Committee or the Board may waive a provision of the code with respect to a Senior Financial Officer. Any such waiver, or any amendment to the code, will be promptly disclosed on our website and as otherwise required by rule or regulation. There were no such waivers or amendments in 2021.

2023.

We encourage employees to disclose alleged wrongdoing that may adversely impact TransDigm, its customers, or

stockholders,shareholders, fellow employees or the public, without fear of retaliation. Our Code of Ethics and Whistleblower Policy set forth procedures for reporting alleged financial and

non-financial wrongdoing on a confidential and anonymous basis, a process for investigating reported acts of alleged wrongdoing, and a policy of

non-retaliation. Reports may be made directly to a supervisor, human resources, operating unit management, executive management, the

Chief Financial Officer orCFO, the Chief Compliance Officer,

the Audit Committee, or Convercent, a third-party service retained on behalf of the Audit Committee. The Audit Committee

chairChair receives notices of complaints and oversees investigation of complaints of financial wrongdoing.

We continually assess our ethics program, including training opportunities, and modify as appropriate. Our managers and supervisors play an important role in reinforcing our policies and commitment to ethics by setting the example of ethical conduct and providing employees with continuous training, education, and resources that support the policies. Employees are encouraged to communicate concerns and contact the identified ethics resource contacts.

Transactions with Related Persons

The Board of Directors reviewshas the responsibility to review, approve, and must approveratify all related party transactions. Proposed transactions between TransDigm and related persons are submitted to the full Board for consideration.consideration on a case-by-case basis taking into account all relevant factors, including whether the terms and conditions are at least as favorable to us as if negotiated on an arm’s-length basis with unrelated third parties. The relationship of the parties and the terms of the proposed transaction are reviewed and discussed by the Board, and the Board may approve or disapprove TransDigm entering intoreject the transaction. All non-de-minimis related party transactions, whether or not those transactions must be disclosed under applicable regulations, are approved by the Board pursuant to these policies and procedures.

| | | | | | | | |

142024 Proxy Statement | | TransDigm Group Incorporated |

Although TransDigm’s policies and procedures for related party transactions are not in writing, the

policy.review, approval and ratification of such transactions are documented in the minutes of the Board meetings.

Several of TransDigm’s Board members and executive officers serve as directors or executive officers of other organizations, including organizations with which TransDigm has commercial and charitable relationships. We do not believeThe Board has concluded that anyno director had a direct or indirect material interest in any such relationships during 20212023 and through the date of this Proxy Statement.Reporting and Transparency

TransDigm publicly discloses substantial information aboutproxy statement.

Shareholder Engagement

We significantly increased our business across ashareholder engagement in 2023, both in terms of the number of shareholder calls and when we solicit feedback from shareholders. We increased the number of shareholder engagement calls by nearly 250% as compared to 2022. We have established a more robust and formalized shareholder engagement program in which we solicit feedback from our shareholders both before and after our 2023 Annual Meeting.

TransDigm believes that dialogue with shareholders and key stakeholders affords our Board and leadership team valuable insights on the most important topics facing our business. We are committed to building our relationships with our shareholders, and we value their perspectives.

Given the unsatisfactory Say-on-Pay results of approximately 51% approval at our 2023 Annual Meeting, our Board has been particularly focused on engagement so we can better understand and be responsive to our shareholders. The feedback we received this year has led to several important changes, including

in our Stakeholder Report which details our commitments, programs, and progress on the environment, diversity, labor and human rights, and ethics. Our Stakeholder Report can be found at www.transdigm.com/investor-relations/corporate-governance.Stockholder Engagement

We proactivelyhow we plan to continue to engage with stockholders and other stakeholdersshareholders moving forward.

How We Engage

We engage with our shareholders throughout the year on the issues that matter to learnthem and matters that are important to TransDigm. Members of our leadership team meet with investors in a variety of forums, including investor conferences, meetings, calls, and other events. Our executive team and Board regularly review shareholder feedback and evaluate the best ways to be responsive while considering the diverse views of all of our key stakeholders and staying true to our vision and culture.

This year, in response to shareholder feedback and in recognition of the value derived from soliciting feedback from our shareholders, we developed a more formal shareholder engagement program. This enables us to better connect with our shareholders, particularly on issues that are not regularly addressed through traditional investor relations channels, such as governance, compensation, and sustainability issues.

| | | | | | | | |

| TransDigm Group Incorporated | | 2024 Proxy Statement 15 |

Shareholder Engagement Process

| | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| •Identify target list of shareholders for proactive engagement and directly outreach to shareholders | | | •Hold active discussions with shareholders on the issues most important to them •Solicit feedback on program enhancements that TransDigm is considering | |

| | | | | |

| | | | | |

| | | | | |

| •Implement selected changes and communicate how changes address shareholder feedback in the proxy statement | | | •Review feedback received during shareholder engagements •Identify priority areas and potential additional enhancements to consider | |

| | | | | |

Enhancement of our Shareholder Engagement Program

Prior to 2023, our shareholder engagement on compensation and governance matters generally consisted of outreach during the period of time between the proxy statement filing and our annual meeting date. Our more formal and enhanced engagement program implemented in 2023, not only includes outreach to shareholders leading up to the annual meeting, but a cycle of outreach mid-year (late summer to fall) to gather feedback subsequent to our annual meeting. Our formalized engagement program is also more robust in our efforts to solicit feedback including persistent follow-up to the shareholders contacted to ensure TransDigm is doing our best to engage with a significant portion of our shareholder base and giving shareholders the opportunity to voice their perspectivesfeedback whether it be positive or constructive.

2023 Engagement

Our leadership team and Board were not satisfied with the outcome of the 2023 Annual Meeting. These results indicated that while we feel that we have strong relationships with our shareholders, we need to invest more time to better understand and address their perspectives.

Following our 2023 Annual Meeting, we reached out to 34 of our top 36 shareholders, which represent over 70% of our outstanding common stock. We conducted engagements with investors representing 62% of our outstanding common stock as result of this outreach. Engagements were led by senior leaders of TransDigm and included participation from the Compensation Committee Chair for select engagements.

| | | | | | | | |

162024 Proxy Statement | | TransDigm Group Incorporated |

Shareholder Outreach Efforts

2023 Feedback and Actions

We received valuable feedback in our conversations with shareholders, and many of our conversations focused specifically on significant issues, including company performance and strategy, corporate governance,our executive compensation program. The Compensation Committee, and environmental, social, and governance topics. This engagement helps us better understand stockholder priorities and perspectives, gives us an opportunity to elaborate upon our initiatives and practices, and fosters constructive dialogue. We takethe Board as a whole, has spent a great deal of time evaluating the feedback and insights fromidentifying enhancements to our engagement with stockholderscompensation program and other stakeholders into consideration asoverall governance structure to address the concerns that were voiced. While we reviewrecognize that we have not been responsive to every individual piece of feedback received, we did thoughtfully consider each piece of feedback. We are pleased to say that we have made meaningful improvements that address our shareholders’ key concerns. Below is a summary of the feedback that we received and evolve our practices and disclosures, and further share them with our Board as appropriate.the improvements we have made in response.

| | | | | | | | | | | |

| What We Heard | | What We Did | |

| | | |

| Shareholders would like us to enhance our engagement efforts throughout the year to discuss key compensation and governance issues. | | We have always appreciated shareholder perspectives and value the dialogue we have had with investors over the years. We recognize that in today's environment, our less formal approach to engagement is not enough. Over the past year, we have formalized our shareholder outreach program to systematically engage with a variety of investors and solicit feedback on key compensation and governance issues. We plan to build on these efforts in the coming years and look forward to the ongoing dialogue. | |

| Shareholders asked us to provide more disclosure in our proxy statement describing our approach to key governance topics. | | Over the past year we have reviewed and revised many key sections of our proxy statement to help our shareholders better understand our governance policies, practices, and procedures. We have added more detailed disclosure on investor priority topics including executive compensation and board composition and have included more direct communication from our directors. We will continue to review our disclosure practices to ensure we are meeting our shareholders' expectations. | |

| Shareholders expressed their concern over our single trigger change-in-control provision. | | We have updated our change-in-control provision for NEOs from single trigger to double trigger to align with investor preferences along with market practice. This change will be made on a go forward basis as NEOs receive new stock option grants. | |

| Shareholders voiced concern over the Compensation Committee's use of discretion in the Annual Incentive Plan. | | For any select discretion utilized for fiscal 2023 annual incentive pay outs, rationale was thoroughly provided within the CD&A. Going forward, the Board will continue to only use discretion in select situations and will provide detailed disclosure regarding their rationale for the decision. | |

| | | | | | | | |

| TransDigm Group Incorporated | | 2024 Proxy Statement 17 |

| | | | | | | | | | | |

| What We Heard | | What We Did | |

| | | |

| Shareholders expressed their desire to see enhanced stock ownership guidelines for our CEO and NEOs and would like to see those guidelines expressed as a multiple of salary. | | We have revised our stock ownership guidelines for our CEO and continuing NEOs. Our guidelines now align with market practice: 6x salary for the CEO and 3x salary for other continuing NEOs, met through a hybrid approach of 50% stock and 50% in-the-money vested stock options. | |

| Shareholders expressed their concern that the same Board members of the Compensation Committee have overseen a compensation plan that has received low Say-on-Pay support for multiple years in a row. | | We have refreshed the committee membership of several Board committees (refer to ‘Board Composition’ section on page 2 of the proxy statement), including the Compensation Committee. David Barr, who previously served on the Nominating and Corporate Governance Committee, has assumed the role of Chair of the Compensation Committee. Additionally, Gary E. McCullough, who is also the Chair of the Nominating and Corporate Governance Committee, has joined the Compensation Committee. Michael Graff, the long-standing Chair of the Compensation Committee, has rotated off the Compensation Committee to join both the Executive Committee and the Nominating and Corporate Governance Committee. Mervin Dunn, a long-standing member of the Compensation Committee, retired from the Board in 2023. The Committee changes reflect our recognition of investors' concerns around accountability and ensure new perspectives and leadership. | |

| Several shareholders expressed an interest in better understanding our peer group and the decision process behind the peer group compilation. | | With the help of external compensation advisors, we reviewed, and significantly revised our peer group. We evaluated companies for inclusion or deletion on several criteria, resulting in an almost 60% turnover in composition. This new peer group is being used starting with our fiscal 2024 compensation plan. We have provided a detailed explanation of our process in the CD&A of this proxy statement. | |

| A few shareholders noted that bringing in new advisors to offer fresh perspectives could be an opportunity for us. | | Following a several months process, we hired Exequity to serve as our new compensation consultant. They, along with other external governance, and compensation experts, have helped us better understand our shareholders' priorities and identify additional ways to be responsive. | |

| Shareholders asked us to adopt a clawback policy. | | We adopted a clawback policy in 2023 that satisfies the regulatory requirements put in place by the SEC and NYSE. | |

| Shareholders questioned the use of the carry-forward/carry-back feature in our compensation plan. | | We recognize that the carry-forward/carry-back feature in our plan is unique to TransDigm. The Compensation Committee believes it is important to retain this feature of our equity awards, and additional disclosure in the CD&A has been included in this proxy statement to better explain how this feature works and its value in being maintained for the equity awards. | |

| Some shareholders expressed concern over perceived misalignment between pay and performance, and a few shared that they would like to see us adopt a relative performance metric in our long-term incentive plan to drive better alignment. | | Our long-term incentive plan is 100% performance-based stock options, which we believe ultimately drives alignment between the overall amount paid to our CEO and the change in value for our shareholders. Further, more than 90% of NEO total compensation is at-risk and performance-based. We believe our emphasis on performance-based compensation drives results for TransDigm and its shareholders. We have received varying feedback over the years on the exact performance metrics that investors prefer to see in long-term incentive plans. Some investors prefer relative metrics, a common metric referenced being relative TSR, while others believe operational metrics are a more appropriate measure. We have an AOP metric, with a five-year measurement period, that we believe is the best reflection of TransDigm’s performance against our long-term strategy as it is based on actual financial results, not the whims of the market. We will continue to solicit feedback on our approach and evaluate how to best incent our executives to drive our performance for TransDigm. | |

| Many shareholders stated that they would like to see a greater degree of responsiveness given the results of our Say-on-Pay vote in 2023. | | We believe that the collective changes we have made, articulated in this table and throughout this proxy statement, demonstrate that our Board took their duty to be responsive to shareholder feedback very seriously. Understanding and addressing shareholder priorities is an ongoing process for our Board. We will continue to solicit feedback and address concerns throughout the year, including as part of our formal shareholder engagement program. | |

| In addition to compensation-focused feedback and changes, we also discussed several governance priorities with investors. |

| | | | | | | | |

182024 Proxy Statement | | TransDigm Group Incorporated |

| | | | | | | | | | | |

| What We Heard | | What We Did | |

| | | |

| Some shareholders suggested that, given our current Board leadership structure, we should consider appointing a Lead Independent Director. | | The Board has appointed Mr. Small as the LID. He will work closely with our Chairman, Mr. Howley, to support the Board in guiding TransDigm forward. His responsibilities in this role are further described on page 8 of this proxy statement. | |

| Shareholders expressed a general concern over the tenure of our Board and certain directors. | | Our Board, led by the Nominating and Corporate Governance Committee, regularly evaluates its "fit-for-purpose." In this process, they seek to identify if the Board as a whole consists of the right skills and expertise to oversee the company today and into the future. This process led to the appointment of Jane M. Cronin in 2021 and Jorge L. Valladares III in 2023. In 2023, Mervin Dunn and John Staer, two long-serving directors, retired from our Board. With these changes, the average tenure of our Board is approximately ten years. | |

| Shareholders voiced their focus on Board diversity and requested greater disclosure on the diversity of our Board. | | We appreciate shareholders' focus on diversity; it is one of the criteria that the Nominating and Corporate Governance Committee consider when searching for director candidates. Our Board is currently 40% diverse, as described on page 2 of this proxy statement. | |

Communications with the Board

Any matter intended for the Board, or for any individual member of the Board, should be directed to Investor Relations, TransDigm Group Incorporated, 1301 East Ninth Street, Suite 3000, Cleveland, Ohio 44114 or at ir@transdigm.com, with a request to forward the communication to the intended recipient. In general, any stockholdershareholder communication delivered to TransDigm for forwarding to Board members will be forwarded in accordance with the stockholder’sshareholder’s instructions. However, TransDigm reserves the right not to forward to Board members any abusive, threatening, or otherwise inappropriate materials or any solicitations of merchandise, publications, or services of any kind. Information regarding the submission of complaints relating to our accounting, internal accounting controls, or auditing matters is available under our Whistleblower Policy at www.transdigm.com/investor-relations/corporate-governance.DIRECTORS

| | | | | | | | |

| TransDigm Group Incorporated | | 2024 Proxy Statement 19 |

Proposal One

Election of Ten Director Nominees to our Board of Directors

This section describes the experience and qualifications of our Board members and how they are compensated.

Directors

TransDigm’s

Proposal No. 1 – Election of Ten Director Nominees to our Board consists of Directors

The Board has nominated Mr. Barr, Ms. Cronin, Mr. Graff, Mr. Hennessy, Mr. Howley, Mr. McCullough, Ms. Santana, Mr. Small, Mr. Stein, and Mr. Valladares to be elected to serve on our Board until the next annual meeting of shareholders and until their successors are duly elected and qualified.

At the annual meeting, proxies cannot be voted for a diverse groupgreater number of highly qualified leadersindividuals than the ten director nominees named in their respective fields. Mostthis proxy statement. Holders of ourproxies solicited by this proxy statement will vote the proxies received by them as directed on the proxy card or, if no direction is made, for the election of the Board’s ten nominees.

Each of the directors

have senior leadership experience at major domestic and multinational companies. In these positions, they have gained significant and diverse management experience, including strategic and financial planning, mergers and acquisitions, capital allocation, public company financial reporting, compliance, risk management, and leadership development. They also have experiencenominated by the Board has consented to serving as

executive officers,a nominee, being named in this proxy statement, and serving on the Board if elected. Each director elected at the annual meeting will be elected to serve a one-year term. If any nominee is unable to serve or

on boards of directors and board committees, and have an understanding of corporate governance practices and trends. In addition, many of our directors have experience serving nonprofit and philanthropic institutions, and bring unique perspectives to the Board.Each Board member was chosen to beotherwise will not serve as a director at the time of the annual meeting, the proxy holders may vote for any nominee becausedesignated by the Nominating & Corporate Governance Committeepresent Board to fill the vacancy.

For more information on the director nominees, please see “Director Nominees for Election” beginning on page 23. The ten nominees receiving the greatest number of votes ‘FOR’ election will be elected as directors. If you do not vote for a particular director nominee, or if you indicate ‘WITHHOLD AUTHORITY’ for a particular nominee on your proxy form, your vote will not count either for or against the nominee. If your shares are held in “street name” by a broker or nominee indicating on a proxy that it does not have authority to vote on this or any other proposal, this will result in a “broker non-vote,” which will not count as a vote for or a vote against any of the nominees.

Board Nominees and Board believe that he or she demonstrated leadership experience, specific industry or manufacturing experience and experience with capital market transactions. Every director holds or has held executive positions in organizations that have provided him or her with experience in management and leadership development. Composition

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Name | Age | Independent | AC | CC | N & CGC | EC | | | | |

| | The Board of Directors recommends that the shareholders vote FOR each of the ten director nominees for election set forth below. | |

| | | | | | | | | |

| David A. Barr | 60 | | |  * * | | | | | |

| Jane M. Cronin | 56 | | l | | l* | | | | |

| Michael Graff | 72 | | | | l* | l* | | | |

| Sean P. Hennessy | 66 | | | | | | | | |

| W. Nicholas Howley, Chairman | 71 | | | | | | | | Our Nominees David A. Barr Jane M. Cronin Michael Graff Sean P. Hennessy W. Nicholas Howley (Chairman) Gary E. McCullough Michele L. Santana Robert J. Small (LID) Kevin M. Stein (President and CEO) Jorge L. Valladares III | |

| Gary E. McCullough | 65 | | | l* | | | | | |

| Michele L. Santana | 53 | | l | | l | | | | |

| Robert J. Small, LID | 57 | | | l | | l | | | |

| Kevin M. Stein, President and CEO | 57 | | | | | | | | |

| Jorge L. Valladares III | 49 | | | | | | | | |

AC: Audit Committee; CC: Compensation Committee; N & CGC: Nominating and Corporate Governance Committee; EC: Executive Committee  Chair lMember * Appointed to the committee in 2023 Chair lMember * Appointed to the committee in 2023 | | | |

| | | |

| | | | | | | | |

202024 Proxy Statement | | TransDigm Group Incorporated |

Director Candidates

The Nominating

& Corporate Governance Committee and

the Board believe that these skills and qualifications, combined with each director’s diverse background and ability to work in a positive and collegial fashion, benefit TransDigm and its stockholders by creating a strong and effective Board.The Nominating & Corporate Governance Committee recommends potential director candidates to the Board. The Nominating &and Corporate Governance Committee identifies nominees by first determining whether current Board members are willing to continue in service. If any Board member does not wish to continue to serve, or if the Nominating &and Corporate Governance Committee or Board decides not to nominate a member for re-election, then the Nominating &and Corporate Governance Committee initially identifies the desired skills and experience in light of the criteria outlinedduties and responsibilities required of a member of our Board and the Board’s oversight role described above. The Nominating &and Corporate Governance Committee then establishes potential director candidates from recommendations from the Board, senior management, stockholdersshareholders, and third parties. The Nominating &and Corporate Governance Committee may retain a search consultant to supplement potential Board candidates if it deems it advisable. In making its recommendations, consistent with the Nominating &and Corporate Governance Committee’s charter, the Committee considers each candidate’s independence, character, ability to exercise sound judgment and demonstrated leadership, as well as diversity, age,

strategic and financial skills, and experience, in the context of the needs of the Board as a whole. The Nominating &and Corporate Governance Committee’s charter requires the selection of prospective Board members with personal and professional integrity who have demonstrated appropriate ability and judgmentjudgment. The Nominating and whom theCorporate Governance Committee believesalso evaluates whether Board member nominees will be effective, in conjunction with the other Board members, in collectively serving the long-term interests of TransDigm and its stockholders. There are no other stated criteria for director nominees.shareholders. However, the Nominating &and Corporate Governance Committee’s charter and our Corporate Governance Guidelines set forth the Board’s commitment to seek out qualified women and minorities to include in the pool from which Board nominees are chosen. In 2021, the Nominating & Corporate Governance Committee,

| | | | | | | | |

| | |

| We are committed to seeking qualified female and minority candidates for the Board. 4 of the last 5 Board members added to the Board were either a female or a minority. | |

| | |

Director Skills

Our Board is comprised of members with

input from our independent directors, Chairmanvaried experiences and backgrounds, which we believe enables thoughtful decision-making. The skills matrix below provides an overview of the

levels of experience that each of our Board

members has in areas that impact our business: accounting/audit/financial experience, global business experience, mergers and

CEO, identified Jane Cronin as a potential candidateacquisitions, risk management, corporate governance, senior leadership experience, operations and

recommended her tobusiness strategy, cybersecurity, and human capital management. The Board assesses the skills of its members and whether additional skills or training would enhance the Board.

Ms. Cronin was appointed toAs a result of this process, the Board

is considering providing opportunities to deepen its experience in

June 2021.cybersecurity.

| | | | | | | | |

| TransDigm Group Incorporated | | 2024 Proxy Statement 21 |

Skills Matrix

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Areas of Expertise | | | | | | | | | | |

| | | | | | | | | | |

| Accounting/Audit/Financial Experience | | | | | | | | | | |

| Global Business Experience | | | | | | | | | | |

| Mergers & Acquisitions | | | | | | | | | | |

| Risk Management | | | | | | | | | | |

| Corporate Governance | | | | | | | | | | |

| Senior Leadership Experience | | | | | | | | | | |

| Operations and Business Strategy | | | | | | | | | | |

| Cybersecurity | | | | | | | | | | |

| Human Capital Management | | | | | | | | | | |

| | | | | | | | |

| | |

| 1 - Expert | 2 - Proficient | 3 - Competent |

A person who has a comprehensive

and authoritative knowledge of or skill

in a particular area | Depth of understanding of discipline and

area of practice; a thorough competence derived from training and practice | Having requisite or adequate ability |

The Nominating

&and Corporate Governance Committee will consider

stockholdershareholder suggestions concerning qualified candidates for election as directors. To recommend a prospective nominee

forto the Nominating

&and Corporate Governance

Committee’sCommittee for consideration, a

stockholdershareholder must submit the candidate’s name and qualifications to TransDigm’s Secretary

Halle Martin, at the following address: TransDigm Group Incorporated, 1301 East Ninth Street, Suite 3000, Cleveland, Ohio 44114. The Nominating

&and Corporate Governance Committee has not established specific minimum qualifications a candidate must have in order to be recommended to the Board. However, in determining qualifications for new directors, the Nominating

&and Corporate Governance Committee will consider potential members’ independence, as well as diversity, age, skill and experience in the context of the Board’s needs as described above.

StockholdersShareholders who wish to nominate directors directly for election at an annual meeting should do so in accordance with the procedures in our

bylaws.Bylaws. In addition, the

bylawsBylaws provide proxy access to eligible

stockholders.shareholders. The proxy access bylaw provides that a

stockholder,shareholder, or group of up to

20 stockholders,twenty shareholders, owning at least 3% of our outstanding common stock continuously for at least three years may submit director nominees for the greater of two directors or 20% of the Board seats provided that the

stockholdershareholder and nominees satisfy the requirements specified in our

bylaws.Bylaws. See

“STOCKHOLDER PROPOSALS FOR 2023 MEETING”“Shareholder Proposals for the 2025 Annual Meeting” for more information about the procedures for direct nominations and proxy access.

Among our 11 nominees for election to the Board, two self-identify as women and one self-identifies as an individual from an underrepresented community.

| | | | | | | | |

222024 Proxy Statement | | TransDigm Group Incorporated |

Director Nominees for Election

The

chart above and the following biographies describe the skills, qualities, attributes, and experience of the nominees that led the Nominating

&and Corporate Governance Committee and the Board to determine that it is appropriate to nominate these directors for election to the Board.

Mr. Laubenthal is not standing for re-election. | | | | | | | | |

DAVID BARR

NOMINATING & CORPORATE GOVERNANCE COMMITTEE

| | David A. Barr 58, has been a director since 2017. He also served as a director from 2003 – 2011. Mr. Barr is managing directorManaging Director of Bessemer Investors, a family ownedfamily-owned private capital fund.fund, since 2017. Formerly Mr. Barr served as a Managing Director of Warburg Pincus LLC, a private equity fund, from 2001 –to 2017. Through Mr. Barr also served as a TransDigm director from 2003 to 2011.

Mr. Barr leverages his private equity leadership experience including as former Managing Director of Warburg Pincus LLC, as well as Co-Head of its Industrial and Business Services Team and member of its Executive Management Group, Mr. Barr bringsto bring a private equity philosophy to the Board consistent with TransDigm’s management approach. Mr. Barr also has extensive public company experience. OTHER CURRENT PUBLIC COMPANY DIRECTORSHIPS

None

SELECTED DIRECTORSHIPS AND MEMBERSHIPS

Good Shepard Services

President’s Council – Wesleyan University

FORMER PUBLIC COMPANY DIRECTORSHIPS IN THE LAST FIVE YEARS

He previously served on the board of Aramark, a food service and facilities services provider, helping guide them through their transition from private to public ownership. Mr. Barr has considerable experience in evaluating and establishing executive compensation at both public and private companies. Former Public Company Directorships In The Last Five Years Builders FirstSource, Inc., a NasdaqNYSE listed supplier of building products and services, through December 31, 2020ARAMARK Holdings Corp., an NYSE listed provider2020.

Selected Directorships And Memberships Good Shepard Services Board of food, facilities and uniform services, through February 2016.Trustees– Wesleyan University |

| David A. Barr | |

| |

| |

Age 60 |

JANE CRONIN

AUDIT COMMITTEE*

|

| |

| |

Director Since 2017 | |

| |

| |

Committees Compensation (Chair) | |

| | |

| | | | | | | | |

| | Jane Cronin, 54, has been a director since June 30, 2021. Ms.M. Cronin is Senior Vice President and Corporate Controller– Enterprise Finance of Sherwin WilliamsThe Sherwin-Williams Company, a manufacturer, developer, distributor, and seller of paint, coatings, and related products. Ms. Cronin has served in her current role since 2016. Prior to that, Ms. Cronin held roles of increasing responsibility at Sherwin Williams,The Sherwin-Williams Company, including Vice President President–Internal Audit and Loss Prevention and Vice President – President–Controller, Diversified Brands division. Ms. Cronin was deemed to be valuable to the Board because of her statusCronin’s experience with accounting and experience as a current accounting officer offinancial matters at a large public company in the manufacturing industry andenables her experience with acquisition integration. Her serviceto provide valuable insight in her role on the Board also provides increased diversity thatand as a member of the Board deems important.*Audit Committee. In addition, Ms. Cronin joined the Audit Committee in October 2021

OTHER CURRENT PUBLIC COMPANY DIRECTORSHIPS

None

SELECTED DIRECTORSHIPS AND MEMBERSHIPS

also has experience with acquisitions and integration, including The Sherwin-Williams Company acquisition of Valspar. Selected Directorships And Memberships Providence House |

| Jane M. Cronin | |

| |

| |

Age 56 | |

| |

| |

Director Since 2021 | |

| |

| |

Committees Audit Nominating and Corporate Governance | |

| | |

| | | | | | | | |

MERVIN DUNN

COMPENSATION COMMITTEE

NOMINATING & CORPORATE GOVERNANCE COMMITTEE*

Mr. Dunn, 68,TransDigm Group Incorporated

| | 2024 Proxy Statement 23 |

| | | | | | | | |

| | Michael Graff has been a director since 2009. Mr. Dunn has been an Operating Advisor of Clearlake Capital Group, a private investment firm, since 2013 and President and Chief Executive Officer of Merv Dunn Management & Consulting, LLC, a private management consulting company, since 2013. Formerly Mr. Dunn was Chief Executive Officer (2016 – 2017) and Co-Chairman of the Board (2013 – 2016) of Futuris Group of Companies Ltd, a privately held automotive supplier. Mr. Dunn is the retired Chief Executive Officer of Commercial Vehicle Group, Inc., a Nasdaq-listed supplier of systems for the commercial vehicle market, a role he held from 1999 – 2013.Mr. Dunn brings to the Board his extensive acquisition experience and experience with domestic and international management of an engineered product business, as well as his experience being the chief executive officer of a public company, all of which are useful to the Board.

* Mr. Dunn served as Chair of the Nominating & Corporate Governance Committee until October 2021

OTHER CURRENT PUBLIC COMPANY DIRECTORSHIPS

None

| | | |

MICHAEL GRAFF

COMPENSATION COMMITTEE, CHAIR

Mr. Graff, 70, has been a director since 2003. Mr. Graff is a Senior Advisor at Warburg Pincus LLC, a private equity firm.firm, since 2020. Prior to 2020, he was a Managing Director of Warburg Pincus LLC since 2003. Formerly, he was President and Chief Operating Officer of Bombardier Aerospace, an aerospace manufacturer.

Mr. Graff brings to the Board a knowledge of acquisitions and capital market transactions to the Board both from his time at Bombardier Aerospace and significantat Warburg Pincus LLC. Mr. Graff’s extensive background and expertise in the aerospace industry, coupled with his financial management and strategic planning and analysis, provides the Board with valuable insight and industry experience that he has used throughout his tenure on the Board, including guiding TransDigm through its initial public offering, the financial crisis, and the COVID-19 pandemic. Mr. Graff’s tenure on the Board and prior public company board experience, both acquired through his positionsin aerospace and private equity, add valuable insight and perspective that have helped TransDigm stay focused and disciplined over time as TransDigm strives to provide private equity returns with Warburg Pincus. Additionally, with his aerospace industry experience, and his previousthe liquidity of the public market. Mr. Graff’s management consulting background at McKinsey Mr. Graff’sCompany contributes to his experience as an industry leader and management perspective is valuable to the Board.OTHER CURRENT PUBLIC COMPANY DIRECTORSHPIS

None

FORMER PUBLIC COMPANY DIRECTORSHIPS IN THE LAST FIVE YEARS

Builders FirstSource, Inc., a Nasdaq-listed manufacturerdemonstrate his strategic planning and distributor, through July 2016

analytical acumen. |

| Michael Graff | |

| |

| |

Age 72 | |

| |

| |

Director Since 2003 | |

| |

| |

Committees Nominating and Corporate Governance Executive | |

| | |

| | | | | | | | |

SEAN HENNESSY

AUDIT COMMITTEE, CHAIR

COMPENSATION COMMITTEE

EXECUTIVE COMMITTEE

Mr.

| | Sean P. Hennessy 64, has served as a director since 2006. He is the retired Senior Vice President, Corporate Planning, Development & Administration of The Sherwin WilliamsSherwin-Williams Company, a manufacturer, developer, distributor, and distributorseller of paint, coatings, and related products, serving in that role from January 2017 –to March 2018 in connection with the company’s integration of its Valspar acquisition. Prior to that, Mr. Hennessy served as Chief Financial Officer of The Sherwin WilliamsSherwin-Williams Company from 2001 –to 2016. He iswas formerly a certified public accountant. As a certified public accountant and former chief financial officer of a large manufacturing public company, engaged in manufacturing, Mr. Hennessy’s finance backgroundbrings a significant wealth of financial and accounting experience and expertise to his role on the Board. His insight and experience of navigating various audit complexities related to acquisitions, as well as general audit matters typical of a large public company experience is valuableinvaluable and critical for his service on the Board and as Chair of the Audit Committee. OTHER CURRENT PUBLIC COMPANY DIRECTORSHIPS

His experience of navigating various financial economic cycles has been and continues to be a valuable resource for TransDigm. Other Current Public Company Directorships Perimeter Solutions, SA, ana NYSE-listed manufacturer of highly engineered forest fire retardant and suppressant chemicals and equipment and oil additives and operator of forest fighting stations, from November 2021SELECTED DIRECTORSHIPS AND MEMBERSHIPS

2021. Selected Directorships And Memberships Sisters of Charity Foundation of Cleveland University Hospitals Miracle Fund |

| Sean P. Hennessy | |

| |

| |

Age 66 |

|

| |

| |

Director Since 2006 | |

| |

| |

Committees Audit (Chair)

| |

| | |

| | | | | | | | |

242024 Proxy Statement | | TransDigm Group Incorporated |

| | | | | | | | |

| | W. NICHOLAS HOWLEYBOARD CHAIR

EXECUTIVE COMMITTEE, CHAIR

Mr.Nicholas Howley 70, was a co-founder ofco-founded TransDigm in 1993 and has been Chairman of the Board since 2003. He was employed as Executive ChairmanChair from 2018 –to August 2021 and served as President and/or Chief Executive Officer of TransDigm from 2003 –to 2018 and of TransDigm Inc. from 1998 –to 2018.

As a TransDigm co-founder, Mr. Howley brings to the Board an extensive understanding of TransDigm’s business. Mr. Howley has played an integral role in TransDigm’s establishment and implementation of its core strategy on an ongoing basis and in its rapid and strategic growth. OTHER CURRENT PUBLIC COMPANY DIRECTORHIPS

Other Current Public Company Directorships Perimeter Solutions, SA, an NYSE-listed manufacturer of highly engineered forest fire retardant and suppressant chemicals and equipment and oil additives and operator of forest fire fighting stations, from November 2021SELECTED DIRECTORSHIPS AND MEMBERSHIPS

Cleveland Clinic

Cristo Rey Network

Drexel Fund

Howley Foundation, Chair

Rock and Roll Hall of Fame

St. Martin dePorres High School

FORMER PUBLIC COMPANY DIRECTORSHIPS IN THE LAST FIVE YEARS

2021. Former Public Company Directorships In The Last Five Years EverArc Holdings Limited, a cash shell company listed on the London Stock Exchange, through November 2021 when it merged with Perimeter Solutions, SA. Selected Directorships And Memberships Cleveland Clinic Cristo Rey Network Drexel Education Fund Howley Foundation, Chair Rock and Roll Hall of Fame Drexel University St. Joseph Preparatory School |

W. Nicholas Howley Chairman | |

| |

| |

Age 71 | |

| |

| |

Director Since 1993 | |

| |

| |

Committees Executive (Chair) | |

| | |

| | | | | | | | |

GARY

| | Gary E. MCCULLOUGHAUDIT COMMITTEE

NOMINATING & CORPORATE GOVERNANCE COMMITTEE, CHAIR*